Create Charles Schwab Account

Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more.

November 16, 2024 18:15

Charles Schwab is a leading financial services company that offers a range of investment, banking, and financial advisory services. Whether you're a seasoned investor or just starting, a Charles Schwab account provides tools, resources, and support to help you achieve your financial goals.

Opening a Charles Schwab account is a straightforward process. In this guide, we'll take you step by step through the account creation process, discuss the benefits of opening an account, and provide tips to manage it effectively. Let's dive in!

Understanding Charles Schwab Accounts

Types of Accounts Offered

Charles Schwab caters to a variety of financial needs. Here's a quick overview of the main account types:

- Individual Brokerage Account: Ideal for buying and selling stocks, ETFs, and mutual funds.

- Retirement Accounts (IRAs): Includes Roth IRA, Traditional IRA, and Rollover IRA options.

- Bank Accounts: Such as checking and savings accounts with low fees and competitive features.

- Custodial Accounts: For managing investments on behalf of minors.

Benefits of Opening an Account

- Low Fees: Schwab offers zero-commission trades on stocks and ETFs.

- Research and Tools: Access to comprehensive tools and market insights.

- 24/7 Customer Support: Assistance when you need it most.

- Mobile Accessibility: Manage your account on the go with Schwab's intuitive app.

Prerequisites Before Opening an Account

Eligibility Criteria

To open a Charles Schwab account, you must:

- Be at least 18 years old (or have a custodian if you're under 18).

- Be a U.S. citizen, permanent resident, or have specific residency status for international accounts.

Documents and Information Needed

- Government-issued photo ID (e.g., driver’s license or passport).

- Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Employer information and financial details (for compliance purposes).

- Bank details for funding your account.

Step-by-Step Process to Open a Charles Schwab Account

Step 1: Visit the Charles Schwab Website

- Go to www.schwab.com.

- Click on "Open an Account" located prominently on the homepage.

Step 2: Choose Your Account Type

- Select the type of account that suits your financial goals (e.g., brokerage account, IRA).

- Review the benefits and features before proceeding.

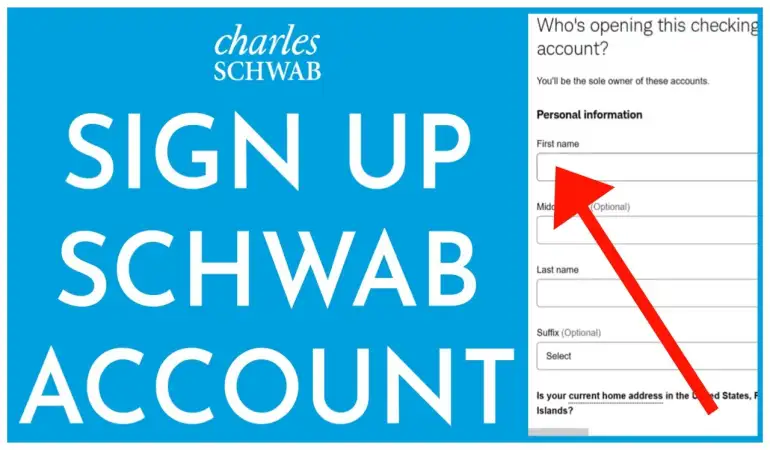

Step 3: Fill Out the Application Form

- Provide personal information such as name, address, and contact details.

- Enter your Social Security Number and employment details.

Step 4: Verify Your Identity

- Upload a copy of your government-issued ID.

- Answer security questions to confirm your identity.

Step 5: Submit the Application

- Double-check all the entered details for accuracy.

- Click “Submit” and wait for an email confirmation.

Funding Your Account

Once your account is approved, the next step is to fund it:

- Bank Transfer: Link your bank account for ACH transfers.

- Wire Transfer: A faster option, though fees may apply.

- Mail a Check: Deposit by sending a physical check to Charles Schwab

ChatGPT said:

Setting Up Online Access

Activating Online Banking Features

After funding your account, it's time to activate your online access. This step enables you to manage your account seamlessly from any device.

- Visit the Charles Schwab website and log in using your account credentials.

- Follow the prompts to create a username and password.

- Enable two-factor authentication for added security.

Using the Charles Schwab Mobile App

The Charles Schwab app is an essential tool for managing your investments on the go.

- Download the app from the Apple App Store or Google Play Store.

- Log in using your online credentials.

- Explore features like real-time market updates, account summaries, and trade executions.

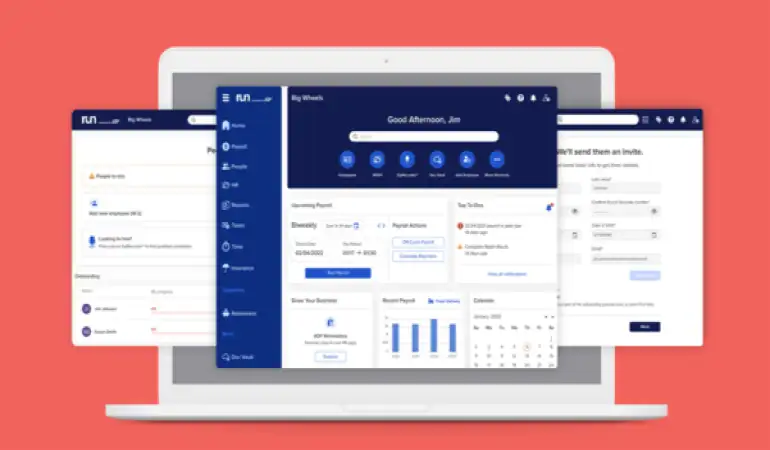

Navigating the Dashboard

Understanding Key Features

The Charles Schwab dashboard is user-friendly and packed with features:

- Account Overview: View your account balance, recent transactions, and portfolio performance.

- Trading Tools: Execute trades, set alerts, and access market research.

- Learning Resources: Schwab provides articles, webinars, and tutorials to help you make informed decisions.

Accessing Tools and Resources

- Use the “Research” tab for insights on stocks, ETFs, and mutual funds.

- Navigate to the “Planning and Advice” section for retirement calculators and investment strategies.

- Explore the “Schwab Intelligent Portfolios” feature for automated investment options.

Managing Your Account

How to Monitor Investments

Staying informed about your investments is crucial for financial success:

- Set up email or SMS notifications for portfolio updates.

- Use Schwab’s analytics tools to track performance trends and market shifts.

Making Transactions

Charles Schwab makes it simple to execute trades or withdraw funds:

- Trading: Place buy/sell orders for stocks, ETFs, and other securities directly through the platform.

- Withdrawals: Use bank transfers or request checks for easy access to your funds.

- Automatic Investments: Set up recurring deposits to grow your portfolio consistently.

Troubleshooting and Customer Support

Common Issues During Account Setup

If you encounter any challenges, here are common problems and solutions:

- Verification Delays: Ensure all documents are clear and submitted correctly.

- Account Ineligibility: Double-check eligibility criteria before applying.

How to Contact Charles Schwab Support

Charles Schwab offers 24/7 support via:

- Phone: Call their toll-free number for immediate assistance.

- Chat: Use the live chat feature on their website or app.

- Email: Submit a query through the “Contact Us” section.

Security Tips for Your Charles Schwab Account

Keeping Your Account Secure

Protecting your account should be a top priority:

- Regularly update your password and use a combination of uppercase, lowercase, numbers, and symbols.

- Enable biometric authentication (like fingerprint or facial recognition) for mobile app logins.

Recognizing Phishing Attempts

Beware of fraudulent emails or calls claiming to be from Charles Schwab:

- Always verify communication through the official website or support channels.

- Never share personal information via email or text.

Benefits of Charles Schwab Account for Investors

Access to Premium Tools and Research

Charles Schwab provides world-class tools to help investors succeed:

- Stock screeners and performance trackers.

- Access to Morningstar reports and Schwab Equity Ratings.

Low Fees and No Account Minimums

- Zero commission on online stock and ETF trades.

- No minimum deposit required to open an account.

Frequently Asked Questions About Charles Schwab Accounts

Is there a fee to open a Charles Schwab account?

No, opening an account is free. There are no account minimums or hidden fees.How long does it take to open an account?

Account setup typically takes 1–2 business days once all documents are submitted.Can I open an account if I’m not a U.S. citizen?

Yes, Schwab offers international accounts for eligible individuals.What is the minimum deposit required?

Charles Schwab does not require a minimum deposit for most accounts.How do I close my account if needed?

Contact customer support to initiate the account closure process.

Conclusion

Creating a Charles Schwab account is a smart move for anyone looking to invest or manage their finances effectively. From understanding account types to navigating the dashboard, the process is straightforward and designed with user convenience in mind. Follow the steps in this guide, and you’ll be ready to take control of your financial future in no time.