Create Fidelity Account

Welcome to the banking that suits your lifestyle!

October 22, 2024 14:29

Create Fidelity Account: Fidelity Investments is one of the most popular financial services providers in the U.S., offering a wide range of investment, retirement, and brokerage accounts. Whether you're looking to invest in stocks, save for retirement, or manage your finances more efficiently, opening a Fidelity account is a smart move.

This guide will walk you through each step of the process so you can open your Fidelity account without any hiccups. Let’s dive in!

What You Need to Open a Fidelity Account

Before starting your application, it’s good to have a few essentials ready:

Identification: You’ll need a government-issued ID like a passport or driver’s license.

Age and Residency: You must be at least 18 years old and a U.S. resident to open most accounts.

Banking Information: For funding your account, you’ll need your bank account and routing numbers.

Step-by-Step Guide to Create a Fidelity Account

Step 1: Visit the Fidelity Website

Start by heading to Fidelity's official website and click on the “Open an Account” button at the top of the page.

Step 2: Choose the Right Account Type

Fidelity offers several accounts, including brokerage accounts, Individual Retirement Accounts (IRAs), and cash management accounts. Select the one that fits your needs.

Step 3: Start the Application Process

Click on “Open Now” under your chosen account type to begin the registration process.

Step 4: Provide Your Personal Information

Fidelity will ask for essential details such as:

1. Name

2. Date of Birth

3. Social Security Number

4. Contact Information (Address, Phone Number, Email)

Step 5: Set Up Account Preferences

Next, you'll configure your communication preferences, including how you want to receive documents (electronically or by mail).

Step 6: Link Your Bank Account

Enter your bank account details to enable fund transfers. This is optional at this stage, but linking a bank account makes it easier to fund your Fidelity account.

Step 7: Review Terms and Conditions

Read through the terms of service and agreements. If you agree, click “I Accept.”

Step 8: Submit the Application

Once all the information is entered and reviewed, click “Submit” to complete the process.

Different Types of Fidelity Accounts Available

Brokerage Accounts: Best for trading stocks, ETFs, and mutual funds.

Retirement Accounts: IRAs and Roth IRAs for tax-advantaged savings.

529 Plans: Education savings accounts for children’s future.

Cash Management Accounts: A hybrid account offering both saving and checking features.

How to Fund Your Fidelity Account

After the account is approved, you’ll need to add funds. Here are the most common methods:

Bank Transfer: Link your bank for direct transfers.

Wire Transfer: Send funds from another institution.

Rollovers: Move funds from another retirement account.

Transfer from Another Broker: Shift assets from other brokers to Fidelity.

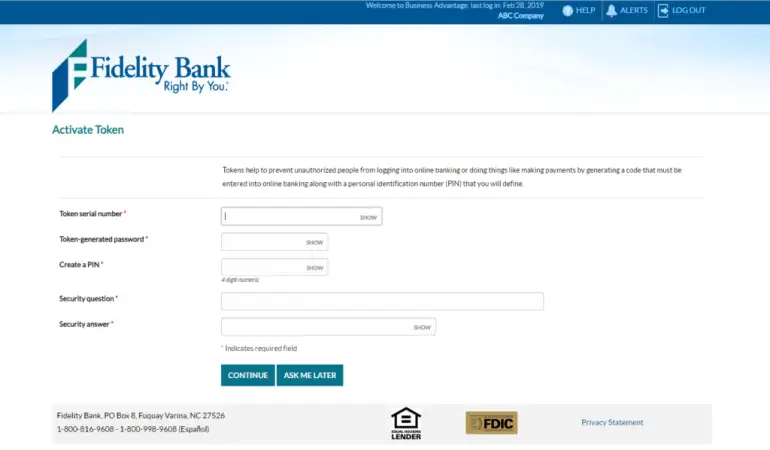

Setting Up Account Security

To keep your account secure:

1. Enable Two-Factor Authentication (2FA) for an extra layer of security.

2. Create a Strong Password: Use a combination of letters, numbers, and symbols.

3. 4. Set Up Alerts to receive notifications about account activity.

What Happens After You Create the Account?

Once you submit the application, Fidelity will review your information. Approval typically takes a few business days. You’ll receive an email with your login details when the process is complete.

Common Issues When Opening a Fidelity Account

Application Rejections: Often due to incomplete or incorrect information.

ID Mismatches: Ensure your personal information matches your identification.

Residency Issues: Some accounts are limited to U.S. residents only.

How to Access Your Fidelity Account Once Approved

After approval, you can log in to your account by visiting the Fidelity website. Use your email and password to enter the dashboard, where you can start exploring investment tools and services.

Tips for Beginners on Fidelity

Start Small: Begin with a manageable investment to learn the ropes.

Utilize Learning Tools: Fidelity offers webinars and tutorials for new investors.

Avoid Common Mistakes: Don’t put all your funds into a single investment.

Fidelity Mobile App: Create and Manage Accounts on the Go

The Fidelity app allows you to manage your account anytime, anywhere. It offers features like mobile deposits, stock tracking, and instant fund transfers. Download it from the App Store or Google Play.

Customer Support: Assistance While Opening an Account

If you encounter any issues during the application process, Fidelity provides multiple support options:

Phone Support: Speak to a representative.

Live Chat: Get instant assistance online.

In-Person Help: Visit a Fidelity branch near you.

How Safe is Your Fidelity Account?

Fidelity employs robust security measures, including encryption and fraud detection systems. Your investments are also protected under SIPC insurance, which safeguards your assets up to $500,000.

Conclusion

Opening a Fidelity account is a straightforward process, but knowing the steps ahead of time can save you from common mistakes. With a Fidelity account, you gain access to a broad range of financial tools and investments, helping you secure your financial future.