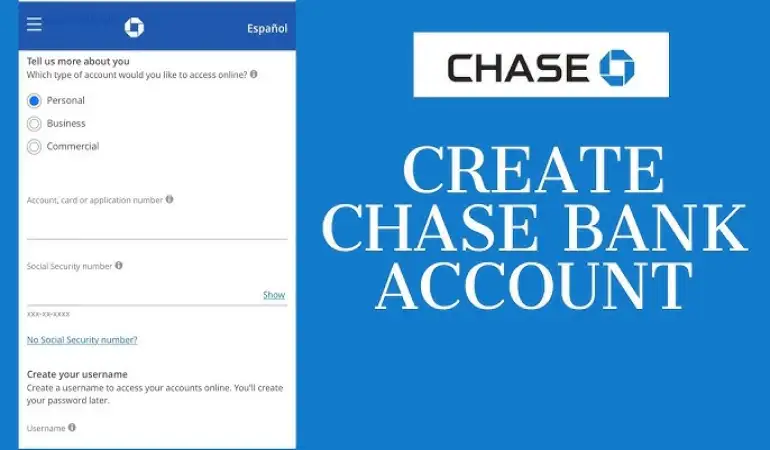

Create Chase Bank Account

Chase serves millions of people with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity ...

November 30, 2024 19:47

Chase Bank, one of the largest and most trusted financial institutions in the United States, offers a range of banking services tailored to individual and business needs. Whether you’re looking to manage your finances efficiently or enjoy premium benefits, a Chase Bank account can help.

The process of opening a Chase account is simple, and this guide will walk you through each step, whether you choose to use the website or the Chase Mobile App.

Requirements to Open a Chase Bank Account

Before you begin, ensure you have the following:

- Valid Identification: This can include a driver’s license, state ID, or passport.

- Social Security Number (SSN) or Taxpayer Identification Number (TIN): Necessary for tax reporting and account verification.

- Proof of Address: Utility bills, lease agreements, or bank statements.

- Email Address and Phone Number: For communication and verification purposes.

- Initial Deposit: Some accounts require a minimum deposit to activate.

Having these ready will save time and make the process smoother.

Choosing the Right Chase Bank Account

Chase Bank offers a variety of account types. Here’s a quick overview:

- Checking Accounts: Ideal for daily transactions and bill payments. Options include Chase Total Checking, Chase Premier Plus Checking, and Chase Secure Banking.

- Savings Accounts: Designed for long-term saving with options like Chase Savings and Chase Premier Savings.

- Business Accounts: Tailored for small business owners and entrepreneurs.

Take a moment to compare the features and benefits of each to find one that aligns with your needs.

How to Create a Chase Bank Account Online (Web)

Opening a Chase Bank account on their website is straightforward. Here’s how:

- Visit the Official Chase Website: Go to chase.com.

- Select “Open an Account”: Navigate to the top menu and click on this option.

- Choose Your Account Type: Select from checking, savings, or business accounts.

- Fill Out the Application Form: Provide details like your full name, SSN, address, and employment information.

- Upload Required Documents: Submit scanned copies of your ID and proof of address.

- Set Up Login Credentials: Create a username and password for online banking.

- Review and Submit: Double-check the details and submit your application.

- Wait for Approval: Chase typically reviews applications within 1–2 business days.

Once approved, you’ll receive an email confirmation with further instructions.

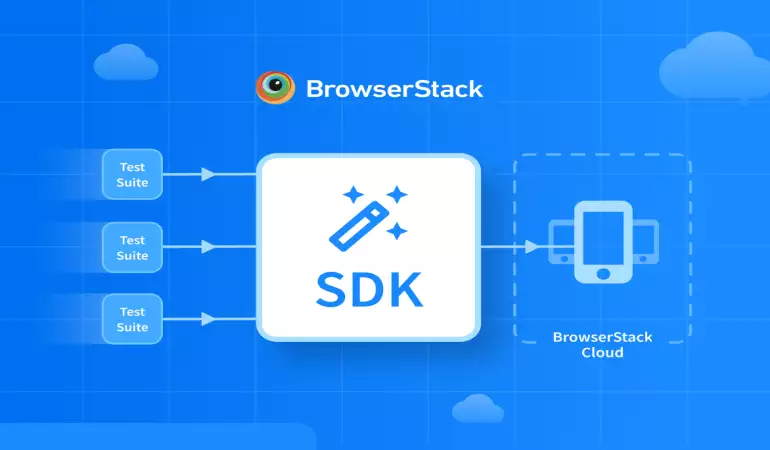

How to Create a Chase Bank Account Using the Chase Mobile App

Prefer the convenience of your phone? The Chase Mobile App makes it easy to open an account. Follow these steps:

- Download the Chase Mobile App: Available on both the Apple App Store and Google Play Store.

- Open the App and Tap “Get Started”: Follow the prompts to begin the process.

- Choose Your Account Type: Select from checking, savings, or other available options.

- Enter Personal Details: Fill in your name, SSN, address, and contact information.

- Upload Documents: Use your phone’s camera to take pictures of your ID and proof of address.

- Set Up Security Features: Enable biometric login or a strong password for added security.

- Review and Submit: Confirm your information and submit the application.

You’ll receive a notification once your account is approved, often within minutes.

Funding Your New Chase Account

To activate your account, you’ll need to make an initial deposit. Here’s how:

- Bank Transfer: Transfer funds from an existing account.

- Credit or Debit Card: Use your card to fund the account.

- Cash Deposit: Visit a Chase branch or ATM for a cash deposit.

Each account type has a minimum deposit requirement, so be sure to check the details. Once the deposit is confirmed, your account is officially active.

ChatGPT said:

Setting Up Online and Mobile Banking

Once your Chase account is active, it’s time to unlock the full potential of Chase’s online and mobile banking features. Here’s a step-by-step guide:

Log In to Your Account:

- For the web: Visit chase.com and log in using the credentials you created during registration.

- For the app: Open the Chase Mobile App and log in with your username and password.

Explore Account Features:

- View balances and recent transactions.

- Access e-statements and set up paperless billing.

Enable Account Alerts:

- Navigate to the “Alerts” section and set up notifications for account activity, balances, or suspicious transactions.

Link External Accounts:

- Use the “Transfer Money” feature to link external accounts for seamless transfers.

Set Up Bill Payments:

- Utilize the “Pay Bills” feature to schedule and automate payments for utilities, credit cards, or other services.

Activate Direct Deposit:

- Get your direct deposit details (account and routing numbers) and provide them to your employer for paycheck deposits.

These features make managing your finances convenient and secure.

Common Issues During Account Setup and Solutions

Although opening a Chase account is usually smooth, you may encounter a few hiccups. Here’s how to handle them:

Verification Delays:

- Ensure your provided documents are clear and legible.

- Double-check personal information for accuracy.

Document Upload Errors:

- Retry using a different browser or device.

- Ensure your document size and format meet Chase’s requirements.

App Crashes or Glitches:

- Update the app to the latest version.

- Restart your device or reinstall the app if necessary.

Customer Support Assistance:

- Call Chase Customer Service at 1-800-935-9935 or use the live chat feature on the website or app.

Prompt action on these issues ensures your account setup process doesn’t hit a roadblock.

Security Tips for Your Chase Bank Account

Your financial security is a top priority. Follow these tips to keep your Chase account safe:

Create a Strong Password:

- Use a mix of uppercase, lowercase, numbers, and special characters.

- Avoid using easily guessed information like birthdays or names.

Enable Two-Factor Authentication (2FA):

- Add an extra layer of security by requiring a verification code sent to your phone or email during login.

Recognize Phishing Attempts:

- Avoid clicking on suspicious links in emails or messages claiming to be from Chase.

- Always verify the sender’s email address or phone number.

Monitor Your Account Activity:

- Regularly review your transactions for unauthorized activity.

- Report any suspicious transactions immediately to Chase.

Secure Your Devices:

- Install antivirus software and keep your operating system updated.

- Use a secure Wi-Fi connection when accessing your account.

These practices protect your finances and ensure peace of mind.

Advantages of a Chase Bank Account

Chase Bank offers numerous benefits, making it a preferred choice for millions. Here are some standout advantages:

Wide Accessibility:

- Over 4,700 branches and 16,000 ATMs nationwide.

- Access your account anytime through the app or website.

Variety of Account Options:

- Choose from basic checking accounts to premium services tailored to your needs.

- Specialized accounts for students, businesses, and travelers.

Rewards and Cashback Offers:

- Eligible accounts and credit cards offer cashback, travel rewards, or other perks.

Integrated Investment Opportunities:

- Seamless integration with J.P. Morgan for investment accounts and wealth management.

Excellent Customer Support:

- Round-the-clock assistance via phone, chat, or in-branch visits.

These features make Chase an all-in-one solution for modern banking needs.

FAQs About Creating a Chase Bank Account

1. How do I create a Chase Bank account?

To create a Chase Bank account, visit the official Chase Bank website or a nearby branch. Select the account type you want (checking, savings, or both) and complete the online or in-person application. You'll need to provide personal information like your name, address, Social Security number, and valid identification.

2. What documents do I need to open a Chase Bank account?

You'll need a government-issued ID (such as a driver's license or passport), proof of address, and your Social Security number. If you're opening the account online, you may also need to upload scanned copies of these documents.

3. Can I open a Chase Bank account online?

Yes, Chase Bank offers an easy online application process. Simply visit their website, choose your preferred account, fill out the application form, and upload the required documents.

4. Is there a minimum deposit to open a Chase Bank account?

Yes, Chase typically requires a minimum deposit to open an account. The amount varies depending on the type of account you choose. Check the account details on the Chase website for the specific deposit requirement.

5. Are there fees associated with Chase Bank accounts?

Some Chase Bank accounts may have monthly maintenance fees, but these can often be waived if you meet specific criteria, such as maintaining a minimum balance or setting up direct deposit.

6. Can non-U.S. residents open a Chase Bank account?

Yes, non-U.S. residents can open a Chase Bank account, but additional requirements, such as a passport and proof of residency in the U.S., may apply. Contact Chase directly for detailed guidance.

7. How long does it take to open a Chase Bank account?

Opening a Chase Bank account can be completed in minutes online or during a short visit to a branch. However, account verification may take up to a few business days.

8. Is Chase Bank account creation secure?

Yes, Chase Bank employs advanced encryption and security measures to ensure that your personal and financial information is protected during the account creation process.

9. Can I link my Chase Bank account to other financial apps?

Yes, Chase Bank accounts can be easily linked to popular financial apps like PayPal, Venmo, and budgeting tools for seamless transactions and financial management.

10. What are the benefits of a Chase Bank account?

Chase Bank offers numerous benefits, including access to online and mobile banking, a wide network of ATMs, and various account types tailored to meet different financial needs.

Conclusion

Opening a Chase Bank account, whether through the website or mobile app, is a simple and rewarding process. With its user-friendly platforms, diverse account options, and robust customer support, Chase ensures you can manage your finances with ease and security. By following this guide, you’ll be well on your way to enjoying the benefits of a Chase Bank account.