Create Wells Fargo Account

Here for life's everyday moments >>> Send money, pay your bills, deposit a check1 — all without missing a beat.

November 16, 2024 17:10

Creating a Wells Fargo account is your gateway to managing finances with ease and convenience. Whether you’re looking for a checking account for daily transactions or a savings account for future planning, Wells Fargo offers a variety of options tailored to meet your financial needs.

In this guide, we’ll break down the process step-by-step to help you open an account effortlessly.

Types of Wells Fargo Accounts

Before diving into the process, it’s essential to understand the types of accounts Wells Fargo offers. Each account is designed with specific features to cater to different needs:

Personal Checking Accounts

These accounts are perfect for daily transactions like paying bills, shopping, or managing direct deposits. Popular options include the Everyday Checking and Portfolio by Wells Fargo.Savings Accounts

Aimed at helping you grow your wealth, Wells Fargo savings accounts come with competitive interest rates and easy access to funds.Business Accounts

For business owners, Wells Fargo provides accounts that simplify payroll, cash management, and business expenses.

Understanding the account types will help you choose the one that aligns with your goals.

Prerequisites for Opening a Wells Fargo Account

To open a Wells Fargo account, you’ll need to gather the following information and documents:

Identification Requirements

A government-issued photo ID, such as a driver’s license, passport, or state ID.Address and Contact Information

Your current residential address and a valid phone number are necessary.Social Security Number (SSN)

Wells Fargo requires your SSN for identification and security purposes.Other Necessary Documents

Non-residents might need additional documentation, such as proof of immigration status or an Individual Taxpayer Identification Number (ITIN).

Online vs. In-Person Account Opening

Wells Fargo offers two convenient ways to open an account: online or by visiting a branch. Each method has its advantages:

Benefits of Opening Online

- Quick and convenient, available 24/7.

- Avoid long queues at the bank.

- Perfect for tech-savvy users.

Benefits of Visiting a Branch

- Personalized guidance from bank representatives.

- Immediate clarification of doubts.

- Ideal for those uncomfortable with digital processes.

Choosing the right method depends on your comfort level and availability.

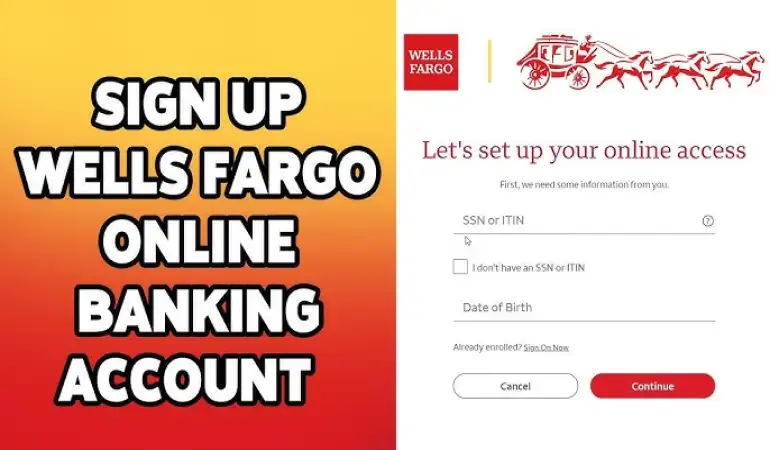

Step-by-Step Guide to Creating an Online Account

Accessing the Wells Fargo Website

Navigate to Wells Fargo’s official website and click on the “Open an Account” button.Filling Out the Application Form

Provide your personal information, including name, date of birth, Social Security Number, and address. Make sure all details match your official documents.Uploading Documents

Scan and upload your government-issued ID and other required documents. Ensure the images are clear to avoid delays.Reviewing and Submitting Your Application

Double-check the information you entered before submitting. Once submitted, Wells Fargo will process your application and notify you via email.

ChatGPT said:

Setting Up Online Banking

Once your Wells Fargo account is approved, the next step is setting up online banking. This allows you to manage your account from anywhere, anytime.

Creating a Username and Password

Start by visiting the Wells Fargo login page. Follow the prompts to set up a unique username and a strong password. Avoid using easily guessable information like your name or date of birth.Linking Your New Account

During the setup, link your newly created account. This step ensures you can access account details, monitor transactions, and manage funds seamlessly.Security Tips for Online Banking

Enable two-factor authentication (2FA) for an added layer of security. Always log out after using public computers, and avoid accessing your account on unsecured Wi-Fi networks.

Activating Your Wells Fargo Debit Card

Once your account is set up, you’ll receive a debit card in the mail within 7-10 business days. This card is essential for making purchases and ATM withdrawals.

Receiving the Debit Card

Ensure you’ve provided a correct mailing address. The card package will include activation instructions.Steps to Activate Your Card

- Call the activation hotline mentioned in the package.

- Alternatively, activate it online by logging into your Wells Fargo account.

- Once activated, sign the back of the card immediately.

This step ensures your card is secure and ready for use.

How to Fund Your New Account

After activating your account, you’ll need to deposit funds to start using it. Here are some ways to fund your Wells Fargo account:

Initial Deposit Methods

Wells Fargo requires a minimum initial deposit, which can be made using cash, a check, or a transfer from another account. For online account setup, you may need to link an external account to fund it.Direct Deposits and Transfers

Set up direct deposits with your employer or transfer money electronically from an existing bank account. Wells Fargo’s routing number and your account number will be essential for these transactions.

Common Issues During Account Creation

While creating your Wells Fargo account, you might encounter some challenges. Let’s address the most common ones:

Trouble with Documentation

Ensure your documents are valid and not expired. If the system rejects your upload, try re-scanning the documents with better clarity.Issues with Online Verification

If you face problems during identity verification, double-check your entered information. For persistent issues, reach out to Wells Fargo’s customer support.

Benefits of Owning a Wells Fargo Account

A Wells Fargo account opens the door to numerous benefits, making it a popular choice for personal and business banking.

Ease of Transactions

Enjoy seamless access to your money through ATMs, online transfers, or debit card payments.Access to Financial Tools

Wells Fargo provides tools like budgeting assistance, savings goals, and credit score tracking to help you stay financially healthy.

Tips for Managing Your Wells Fargo Account

Efficient management of your account ensures you get the most out of it. Here are some essential tips:

Regular Monitoring of Transactions

Use the online banking portal or mobile app to monitor your transactions and stay alert for unauthorized activity.Setting Up Alerts

Enable notifications for balance updates, large transactions, or unusual activity to maintain control over your finances.

How to Contact Wells Fargo for Assistance

Wells Fargo provides multiple channels to assist you with any issues or inquiries:

Customer Service Hotline

Call the official helpline for immediate support. Keep your account details handy for quicker resolution.Visiting a Local Branch

For complex issues, visiting a branch allows face-to-face interaction with a banking representative.Online Help Resources

Browse the FAQ section on Wells Fargo’s website or use the online chat feature for quick answers.

Security Tips for Your Wells Fargo Account

Your account security is paramount. Follow these tips to keep your funds safe:

Protecting Your Login Credentials

Regularly update your password and avoid sharing it with anyone.Recognizing Fraudulent Emails and Calls

Wells Fargo will never ask for sensitive information via email or phone. Report any suspicious activity immediately.

Closing Thoughts

Creating a Wells Fargo account is a straightforward process that opens the door to convenient financial services. By following this guide, you can confidently navigate each step, from selecting the right account to activating and managing it effectively. So why wait? Start your financial journey with Wells Fargo today.