Create Experian Account

Experian is committed to helping you protect, understand, and improve your credit. Start with your free Experian credit report and FICO® score.

November 30, 2024 20:16

In today’s financial world, keeping an eye on your credit health is crucial. Experian, one of the leading credit bureaus, offers tools and resources to monitor and improve your credit score. Whether you’re planning a big purchase, applying for a loan, or just want to safeguard against fraud, having an Experian account is essential.

This guide walks you through the simple steps to create your Experian account, whether you prefer using a web browser or the mobile app.

Understanding Experian

Experian is one of the three major credit bureaus in the U.S., responsible for collecting and maintaining consumer credit information. It provides services like credit monitoring, identity theft protection, and free credit reports.

Why You Need an Experian Account

- Credit Monitoring: Stay updated with changes to your credit file.

- Fraud Protection: Get alerts for suspicious activities.

- Access to Reports: View detailed insights about your credit score and history.

Preparation Before Creating an Experian Account

Documents and Information Needed

To ensure a seamless registration process, gather the following:

- Social Security Number (SSN): Required for identity verification.

- Personal Information: Date of birth, full name, and residential address.

Device and Connectivity Requirements

- For Web: Use an updated browser like Chrome, Firefox, or Safari.

- For Mobile App: Ensure your smartphone runs on iOS 12+ or Android 8.0+.

How to Create an Experian Account on the Web

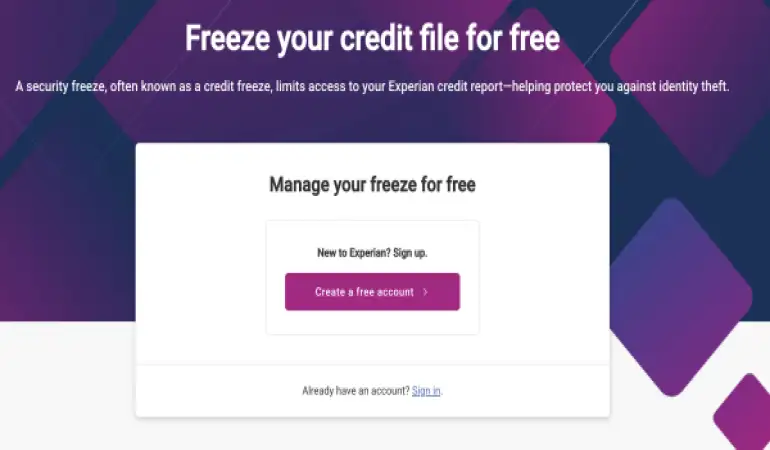

Step 1: Visit the Experian Website

Open your preferred browser and go to Experian's official site.

Step 2: Click on “Sign Up”

Locate the “Sign Up” or “Start for Free” button on the homepage.

Step 3: Enter Your Personal Information

Fill out the form with accurate details, including your name, date of birth, and address.

Step 4: Set Up Your Login Credentials

Create a unique username and a strong password. Remember to include a mix of letters, numbers, and symbols.

Step 5: Verify Your Identity

Answer security questions or upload supporting documents if required. Experian may use a soft credit inquiry to verify your identity.

Step 6: Review and Complete the Registration

Double-check your details, agree to the terms, and click “Submit.”

How to Create an Experian Account Using the Mobile App

Step 1: Download the Experian App

- For iOS users: Go to the App Store.

- For Android users: Visit the Google Play Store.

Search for “Experian” and download the app.

Step 2: Launch the App and Start Registration

Open the app and tap “Sign Up.”

Step 3: Fill Out the Registration Form

Provide the requested details, such as your name, SSN, and email address.

Step 4: Choose Your Login Credentials

Set up a username and password that are easy for you to remember but secure.

Step 5: Identity Verification

Complete the security questions or upload any necessary documents.

Step 6: Finalize the Account Setup

Review the information, accept the terms, and submit the registration form.

Tips for Using Your Experian Account

- Navigate the Dashboard: Familiarize yourself with tools like the credit report summary and credit score tracker.

- Set Alerts: Enable notifications for important updates or suspicious activities.

- Access Credit Reports: Regularly review your credit report to spot discrepancies.

Troubleshooting Common Issues

Error During Registration

Ensure your information matches your official records. Clear browser cache if using the web.

Forgot Login Credentials

Use the “Forgot Password” feature to reset your credentials securely.

Identity Verification Problems

Contact Experian’s support for manual verification if automated methods fail.

Conclusion

Creating an Experian account is your first step toward better financial health. Whether you use their website or mobile app, the process is simple and secure. Start monitoring your credit, protecting against fraud, and empowering yourself with financial insights today.