One - Mobile Banking

Rating: 0.00 (Votes:

0)

In today's fast-paced world, mobile banking has revolutionized the way we manage our finances. With the convenience of mobile banking applications, users can conduct various banking transactions anytime and anywhere. This article delves into the latest version of mobile banking APK for iPhone, providing a comprehensive guide on its features, benefits, and how to download it for free.

What is Mobile Banking APK?

Mobile Banking APK refers to the Android Package Kit that enables users to install mobile banking applications on their devices. Although primarily designed for Android, many APK files are compatible with iOS devices, offering iPhone users a seamless banking experience.

Key Features of One - Mobile Banking APK for iPhone

User-Friendly Interface

The latest version of the mobile banking APK for iPhone boasts a user-friendly interface that ensures ease of navigation. The intuitive design allows users to access various banking functions without any hassle, making it suitable for users of all ages.

Enhanced Security Measures

Security is paramount in mobile banking. The latest version incorporates advanced security features such as biometric authentication (fingerprint and facial recognition), two-factor authentication, and end-to-end encryption to safeguard users' personal and financial information.

Real-Time Notifications

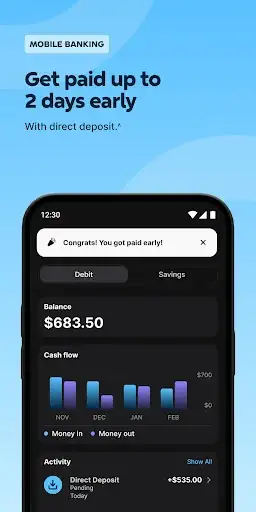

Stay updated with real-time notifications on account activities. The mobile banking APK sends instant alerts for transactions, ensuring users are always informed about their financial status.

Comprehensive Financial Management Tools

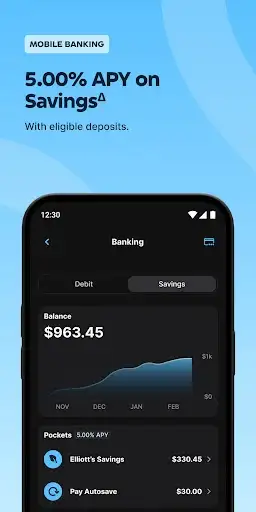

Manage your finances effectively with a suite of financial management tools. The APK includes features such as budgeting tools, expense trackers, and investment management, empowering users to take control of their financial health.

24/7 Customer Support

Experience unparalleled customer support with 24/7 assistance. Whether you encounter technical issues or have queries regarding your account, the mobile banking app offers round-the-clock support to address your concerns promptly.

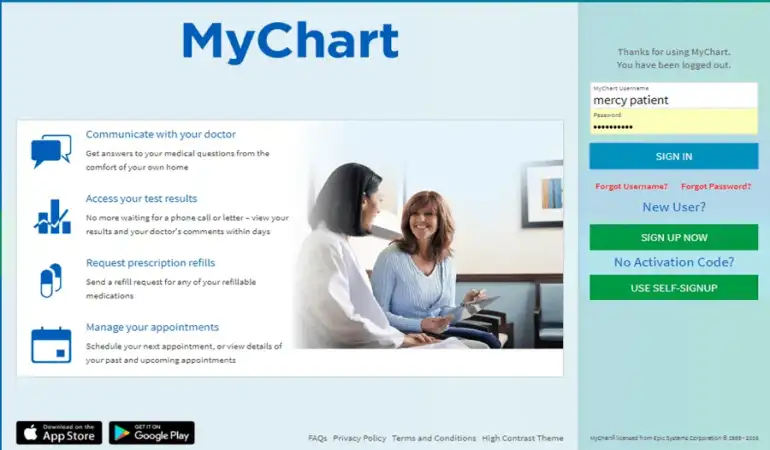

How to Download the Latest Version of One - Mobile Banking APK for iPhone

Downloading the latest version of the mobile banking APK for iPhone is a straightforward process. Follow these steps to get started:

Visit the Official Website: Navigate to the official website of your bank or the APK provider.

Find the Download Link: Look for the download link for the latest version of the mobile banking APK.

Enable Unknown Sources: Go to your iPhone's settings, select "Security," and enable the installation from unknown sources.

Download and Install: Click on the download link and wait for the APK file to download. Once downloaded, open the file and follow the on-screen instructions to install the application.

Launch the App: After installation, launch the app and log in with your credentials to start using the mobile banking services.

Benefits of Using Mobile Banking APK for iPhone

Convenience

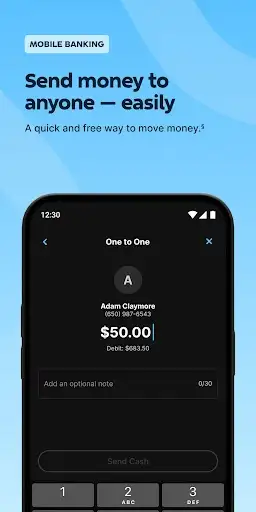

Mobile banking brings unparalleled convenience. Users can perform banking transactions such as fund transfers, bill payments, and check account balances from the comfort of their homes or on the go.

Time-Saving

Say goodbye to long queues at the bank. With the mobile banking APK, you can complete transactions in minutes, saving valuable time and effort.

Accessibility

Access your bank accounts 24/7. The mobile banking app ensures you can manage your finances at any time, eliminating the constraints of traditional banking hours.

Cost-Effective

Many banks offer free or low-cost mobile banking services. This can significantly reduce the costs associated with traditional banking, such as transportation and service fees.

Enhanced Financial Management

The financial management tools available in the mobile banking APK help users budget, track expenses, and plan for the future, leading to better financial health.

Frequently Asked Questions (FAQs)

Is it safe to download the mobile banking APK for iPhone?

Yes, downloading the mobile banking APK from the official website of your bank or a trusted provider is safe. Ensure you have updated antivirus software on your device for added security.

Can I use the mobile banking APK on multiple devices?

Most banks allow you to use the mobile banking APK on multiple devices. Check with your bank for specific guidelines and ensure you follow their security recommendations.

What should I do if I encounter issues with the mobile banking APK?

If you encounter any issues, contact the customer support team available 24/7 through the mobile banking app. They can assist you with troubleshooting and resolving any problems.

Are there any additional charges for using the mobile banking APK?

While many banks offer free mobile banking services, some may charge nominal fees for certain transactions. Check with your bank for detailed information on any applicable charges.

Can I use the mobile banking APK without an internet connection?

Certain features, such as viewing account balances, may be accessible offline. However, for most transactions and real-time updates, an internet connection is required.

Conclusion

The latest version of the mobile banking APK for iPhone is a powerful tool that combines convenience, security, and comprehensive financial management. By following the simple steps to download and install the APK, users can enjoy a seamless and efficient banking experience. Embrace the future of banking with the mobile banking APK and take control of your financial well-being today.

User ReviewsAdd Comment & Review

Based on 0

Votes and 0 User Reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

Tech News

Other Apps in This Category